Analysis of the Operating Conditions of China's Printing Industry from January to June 2022

Time:2022-08-12 From:

From January to June 2022, enterprises above designated size in China's printing industry realized operating income, a year-on-year increase of 1.1%; realized total profits, a year-on-year decrease of 7.2%. In the first half of the year, the operating income increased slightly and the profit decline narrowed.

Overall Trend Analysis

In the first half of the year, China's GDP growth rate was 2.5%. In terms of quarters, the first quarter increased by 4.8% year-on-year, and the second quarter increased by 0.4%. In the second quarter, affected by unexpected factors such as the complex evolution of the international environment and the impact of the domestic epidemic, the downward pressure on the economy increased significantly. The main economic indicators fell deeply in April, narrowed the decline in May, and stabilized and rebounded in June. The economy achieved weak positive growth in the second quarter.

From the perspective of industrial production, in the first half of the year, the industrial added value of all industries (enterprises above designated size) increased by 3.4% year-on-year. Due to the impact of the epidemic, the added value of industrial enterprises above designated size in the second quarter increased by 0.7% year-on-year, of which it fell by 2.9% in April, increased by 0.7% in May, and further accelerated to 3.9% in June. The trend of stabilization and recovery is relatively obvious.

In June 2022, the industrial added value of the printing industry increased by 4.3% year-on-year, compared with 0.9% in May, the growth rate has accelerated, and the growth rate is higher than the average level of all industries.

Revenue and Profit Analysis

From January to June 2022, enterprises above designated size in China's printing industry realized operating income, a year-on-year increase of 1.1%. Compared with 0.8% from January to May, the growth rate has increased. During the same period, all enterprises above the industrial scale achieved operating income, a year-on-year increase of 9.1%. The significant gap between the revenue growth rate of the printing industry and the printing industry shows that the industry is still under heavy pressure, and it belongs to one of the 41 major industrial sectors with a slow recovery in growth rate.

From January to June 2022, the total profits of enterprises above designated size in the printing industry decreased by 7.2% year-on-year. Compared with the first five months, the decline continued to narrow (the total profit in June changed from a decline to an increase, which was 3.8%). During the same period, the total profits of all enterprises above industrial scale increased by 1.0% year-on-year. Among the 41 major industries, the total profit of 16 industries increased year-on-year, 25 industries declined, and the printing industry was still in the decline camp.

Let's take a look at the revenue and profits of large-scale Indian companies in Shanghai. From January to June 2022, the operating income of large-scale printing enterprises in Shanghai decreased by 26.3% year-on-year, and the total profit decreased by 87.4% year-on-year. Among the major industrial industries in Shanghai, the two indicators of the printing industry were at the lowest values. The resumption of work and production in Shanghai's printing industry still needs to go through a difficult recovery period.

Observing the paper industry, which is closely related to the printing industry, from January to June, the growth rate of operating income of the paper and paper products industry was 2.5%, and the growth rate of total profit was -46.2%. In comparison, the profitability of the paper industry is even more severe.

Benefit status analysis

In June 2022, the loss ratio of enterprises above designated size in the printing industry was 25.2%, and the total loss of loss-making enterprises increased by 29.3%. For two consecutive months, both the area of ??losses and the total amount of losses have decreased. However, it can be seen from Figure 3 that the monthly losses this year have increased considerably compared to the same period last year.

From January to June 2022, the profit margin of the printing industry's operating income was 4.82%, which has rebounded from the previous month, but it has dropped significantly compared to the same period last year. Compared with the average level of 6.53% in all industries, there is also a considerable gap. The increase in costs of raw materials, labor, and logistics are all important factors leading to a decline in profits.

From January to June 2022, the cost per 100 yuan of operating income in the printing industry was 84.86 yuan, which was higher than the average level of 84.52 yuan for all industries. This figure has also increased compared to 84.48 yuan in the same period last year.

Asset Quality Analysis

At the end of June 2022, the asset-liability ratio of enterprises above designated size in the printing industry was 46.71%, an increase from 46.42% at the end of last month. Compared with the 56.9% asset-liability ratio of all industries at the end of June, the overall debt level of printing companies is relatively low.

At the end of June, the average payback period of accounts receivable of enterprises above designated size in the printing industry was 58.7 days, a significant decrease from 59.8 days at the end of the previous month, but a considerable increase from 56.0 days in the same period of the previous year. At the end of June, the average payback period of accounts receivable for all industries was 53.7 days. In contrast, the financial pressure of printing companies is still high.

At the end of June, the inventory turnover days of finished products of enterprises above designated size in the printing industry was 18.1 days, which was a decrease from 18.5 days at the end of last month.

Export Delivery Value Analysis

From January to June 2022, the export delivery value of the printing industry increased by 11.1% year-on-year, an increase from January to May. In June, the export delivery value of the printing industry increased by 16.1% year-on-year, which continued to increase from the 14.4% growth rate in May, changing the downturn of 4.3% in March and 1.2% in April. It is expected that in the second half of the year, the growth momentum in May and June will continue.

Price Index Analysis

With the help of producer price index, we can observe the dynamics of market price changes in various industries.

Figure 6 shows the price action since January 2020. The pulp price index (green line) rose after the phased bottom in April-May, and the paper price index (blue line) did not rise simultaneously, but fell in June.

The producer price index of the printing industry declined in June after a significant decline in May; the price index of bookbinding and printing-related services declined from the previous month.

Trend analysis of some industries

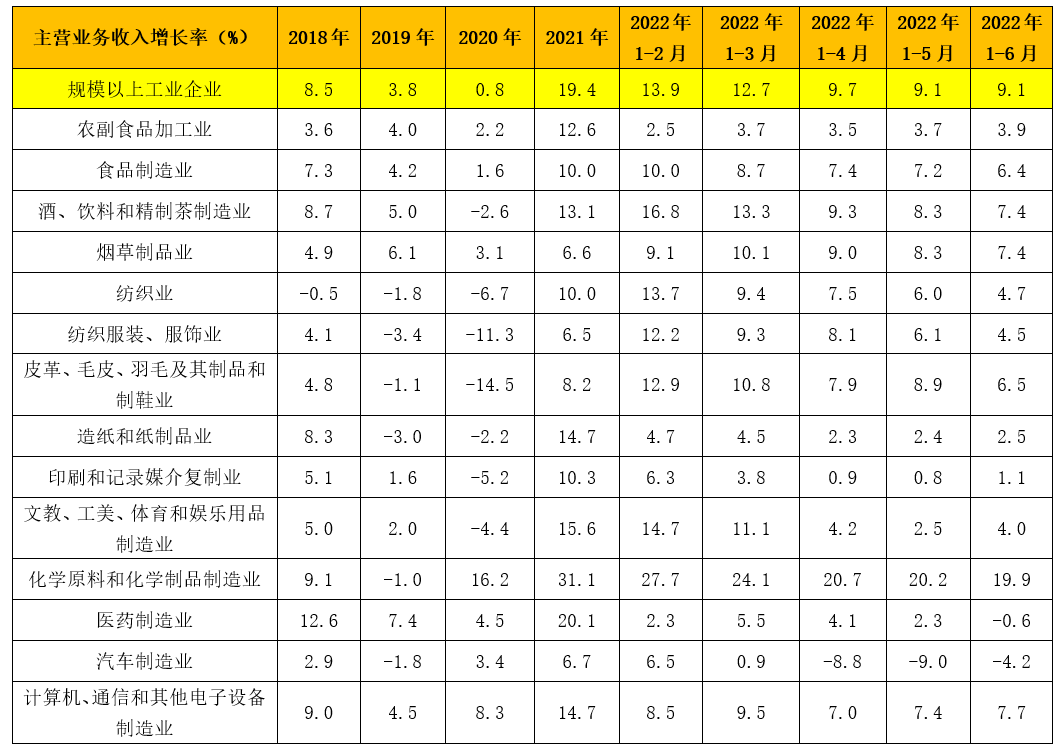

Table 1 shows the growth of main business income of some industries closely related to the printing industry among the 41 major industries. Most of these industries are the customer industries served by the printing industry, and there are also upstream industries such as papermaking.

From January to June 2022, the average growth rate of the main business income of all industries is 9.1%, the same as that of the previous month.

Table 1 Growth rate of main business income of some industries

In terms of industries, the basic consumer goods industries related to residents' lives, such as agricultural and sideline food, food manufacturing, alcoholic beverages, tea, tobacco and other industries, have basically maintained a stable growth rate; The growth rate of the footwear industry is generally not high; in the industrial product industry, the growth of the automobile manufacturing industry accelerated significantly in June, the chemical manufacturing industry still maintained a considerable growth rate, and the computer communication and other electronic equipment manufacturing industries continued to maintain stable development.

Generally speaking, the risk of stagflation in the global economy is rising, and there are still many unstable and uncertain factors in the recovery of the domestic economy. The revenue and profit growth of the printing industry are still under pressure, and the loss of enterprises is still relatively large. The production and operation of printing enterprises still face many difficulties and challenges. . It is expected that printing companies can gradually overcome the problems of insufficient orders, weak expectations, and cost issues, boost confidence, strengthen resilience, and strive to maintain sustainable development.